The LEI Code Structure is a globally recognized framework defined under the ISO 17442 standard to provide every legal entity involved in financial transactions with a unique and verifiable identity. Comprising 20 alphanumeric characters, the structure is carefully designed to ensure consistency, accuracy, and transparency across international markets. By standardizing how entities are identified, the LEI Code Structure plays a vital role in strengthening regulatory compliance, reducing financial risks, and building trust in cross-border trade and reporting.

In today's interconnected financial landscape, the importance of unique identifiers cannot be overstated. The LEI code, issued in accordance with ISO 17442, plays a pivotal role in enhancing the transparency and reliability of financial transactions worldwide. This article delves into the intricacies of the LEI code structure, its issuance, and its implications for the global financial ecosystem.

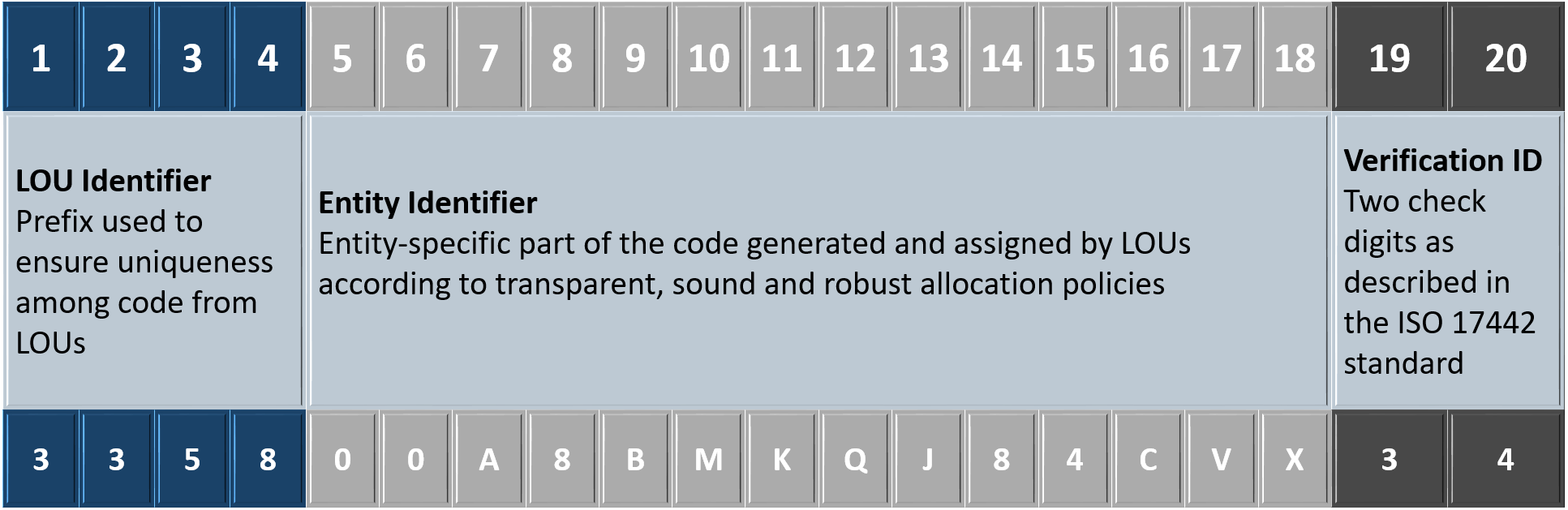

First 4 Characters: Entity Identifier: These four characters are used to identify the entity issuing the LEI. It is typically the code of the organization responsible for assigning LEIs.

Next 2 Characters: Reserved Characters: These two characters are reserved for special purposes and are used to fill the second part of the code, which separates the issuer's code from the actual entity code.

Last 2 Characters: Checksum: The final two characters are used to verify the validity of the LEI code through a checksum calculation. They help prevent errors in the code's transcription or use.

An LEI (Legal Entity Identifier) is a unique 20-character alphanumeric code that identifies distinct legal entities participating in financial transactions. This identifier is crucial for regulatory reporting and financial transparency.

The LEI code consists of four parts:

Global Standardization: LEI codes provide a standardized way to identify entities across international financial markets. This helps reduce errors, simplifies data management, and allows for better transparency in financial transactions.

Regulatory Compliance: Many financial institutions are required to collect and report LEI codes as part of regulatory compliance with financial regulations like MiFID II in Europe or Dodd-Frank in the United States.

Enhanced Transparency: By linking financial transactions to identifiable legal entities, LEIs help authorities, regulators, and market participants track risks and relationships more accurately.

Purpose of LEI in Global Business: The LEI aims to improve the accuracy of financial data, reduce risk, and help with regulatory compliance by offering a global standard for entity identification.

Updating LEI Details: Legal entities are required to update their LEI details if there are any significant changes in their structure, such as mergers or name changes.

Renewal Process and Fees: LEI codes must be renewed annually. The renewal process involves submitting updated documentation and paying a renewal fee. Fees vary depending on the issuer and region.

LEI Code Verification Process: LEI codes can be validated through the LEI issuing organizations and the GLEIF, which provides a public database of valid LEIs. This ensures that the code corresponds to the correct entity.

Common Issues in LEI Validation: Some issues can arise when an entity's details do not match the database records, such as incorrect or outdated information, expired LEIs, or issues with the assigned LEI issuer.

LEIs are assigned by Local Operating Units (LOUs), which are authorized by the Global Legal Entity Identifier Foundation (GLEIF). Each LOU operates in specific jurisdictions and assigns LEIs to entities based on the legal requirements.

Companies and organizations must apply to an LOU, provide the necessary documentation to prove their legal existence, and receive their LEI code.

The ISO 17442 standard specifies the structure and implementation of the LEI code. This standard ensures consistency and uniformity in the issuance and management of LEIs across the globe.

The LEI code, issued as per ISO 17442 standard, is a cornerstone of modern financial transparency. Its unique structure, rigorous issuance process, and global adoption make it an indispensable tool in the financial world. By understanding the intricacies of the LEI code and its implications, financial professionals can better navigate the complexities of today's interconnected financial landscape.

For businesses, obtaining an LEI is a step toward ensuring legal compliance in the financial space. The code is used in reporting transactions and trade details to regulators and authorities. As such, it enhances a company’s credibility and ensures it can participate in financial markets without issues.

The LEI code structure is an essential component in global financial transparency. It ensures businesses are identifiable across borders, helping to streamline regulatory processes and enhance financial market integrity. Whether you are a multinational corporation or a smaller firm engaging in financial activities, securing an LEI code is crucial for staying compliant with international financial regulations.

Transparency and Efficiency in Global Trade: LEI codes provide a universal way to identify entities, which enhances transparency in financial markets, reduces fraud, and simplifies compliance processes for international trade.

Challenges in Implementing LEI Globally: The adoption of LEI codes worldwide faces challenges like lack of awareness, resistance from smaller entities due to costs, and technical difficulties in integrating LEI systems across different countries and industries.

Potential Developments in LEI Usage: As financial markets continue to globalize, LEI adoption is expected to expand, with more entities using LEIs for regulatory reporting, due diligence, and risk management. There is potential for greater integration with other technologies like blockchain.

Role of LEI in Emerging Markets: LEI could play a significant role in emerging markets, helping to establish credibility and foster trust in financial systems that are still developing.

FAQs: LEI Code Structure (as per ISO 17442 Standard)

1. What is an LEI Code?

The Legal Entity Identifier (LEI) is a unique 20-character identifier assigned to legal entities involved in financial transactions. It helps distinguish entities in the global financial market, ensuring transparency and accuracy in financial data.

2. Who issues LEI Codes?

LEI codes are issued by Local Operating Units (LOUs) that are authorized by the Global Legal Entity Identifier Foundation (GLEIF). These LOUs operate in specific regions and are responsible for issuing LEIs to legal entities based on their registration and documentation.

3. What is the structure of an LEI code?

A Legal Entity Identifier (LEI) is a 20-character alphanumeric code structured according to the ISO 17442 standard. It is designed to uniquely identify legal entities participating in financial transactions.

4. What is the significance of the ISO 17442 standard?

The ISO 17442 standard defines the LEI structure and ensures global consistency in how legal entities are identified across financial markets.

5. Who ensures compliance with the ISO standard for LEIs?

The Global Legal Entity Identifier Foundation (GLEIF) oversees the LEI system and ensures all LOUs issue codes in compliance with ISO 17442.

6. Is the LEI structure the same worldwide?

Yes. All LEIs follow the same ISO 17442 structure, regardless of the country or registration authority.

7. What is the purpose of ISO 17442 in LEI?

ISO 17442 ensures a standardized format for LEIs globally. It provides consistent rules for issuing and validating LEIs to enhance transparency in identifying legal entities across jurisdictions.